FinPay, a recognized leader in patient engagement and financial management, is ranked No. 4 on the...

Build a Strong Foundation for Patient Financial Management

June 28, 2023

Written by: Christopher Wolfington

For a behavioral healthcare provider, being mission-driven means first adhering to the principles that treatment works and recovery is possible for all. But when providers allow patient financial stress to distract from a focus on getting well, this can quickly derail the pursuit of patient goals. If providers don't devote enough attention to simplifying the patient financial experience, the adage from Thomas Edison will come into play: “Vision without execution is hallucination.”

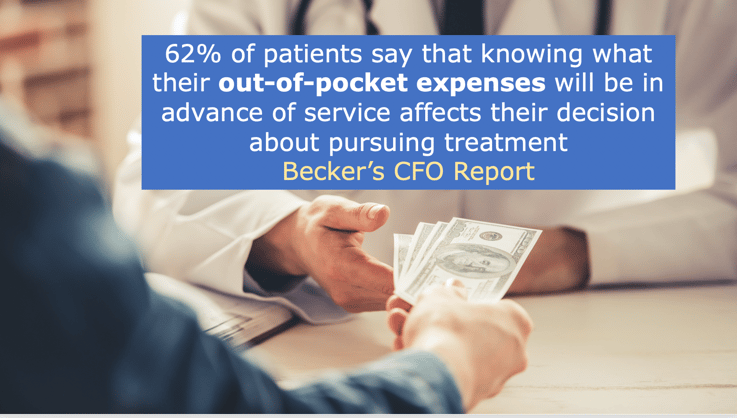

Why is it so important for behavioral health providers to establish a strong foundation for patient financial management? When the decision to seek help is already fraught with ambivalence and doubt, a patient's concern about ability to pay could tip the balance against seeking admission. According to data presented in Becker's CFO Report, 62% of patients say that knowing what their out-of-pocket expenses will be in advance of service affects their decision about pursuing treatment.

When patients already face many unknowns about how their treatment will proceed and what their lives will look like afterwards, financial worries can only function to worsen the risk of an adverse outcome. Providers need to consider patient financial management a core focus of their operations, adopting a strategy that will both enhance the patient experience and improve the organization's bottom line. Having the right financial conversations with patients will ensure that during treatment, attention to the patient's clinical needs will remain paramount.

A sound structure for patient financial management is built on several pillars — a lack of attention to any of them will cause harm clinically and to the business. The first area of importance is admissions enablement, or the actions taken at the front end to make the financial part of the transaction more predictable for patients and providers. The behavioral healthcare industry's performance in this area has simply been unacceptable. As a stark example, more than 9 in 10 addiction treatment providers fail to use a data-driven pre-admission strategy to engage patients. Without careful advance planning, patients are likely to discover surprise charges during treatment and to struggle over paying their medical bills.

The other barriers emanate from this failure to plan. Not having a pre-admission strategy leads to uncertainty in census. Communicating all options to prospective patients clearly and transparently will expedite the patient call process and lead to greater stability in the census. According to the Substance Abuse and Mental Health Services Administration (SAMHSA), 39% of behavioral health admissions are lost to mishandling or absent financial conversations.

After admission, any surprise charges or other unexpected financial hurdles will likely hamper a patient's adherence to the treatment plan. Conversely, a predictable payment process will increase the likelihood of treatment completion. When the patient is engaged in treatment that is tailored to individual clinical needs, a sufficient length of stay makes a big difference toward achieving a lasting recovery.

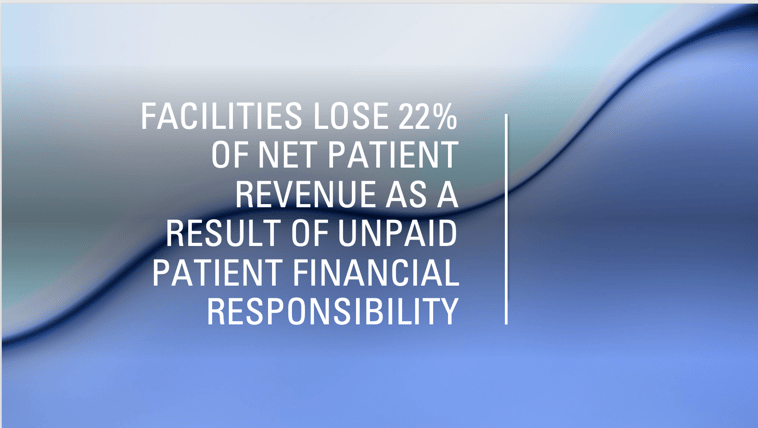

Sound patient financial management also will improve the organization's prospects for increasing average net patient revenue, from the combination of insurance and patient payments. Again, the numbers suggest there is much room for improvement in the industry. Data show that facilities lose 22% of net patient revenue as a result of unpaid patient financial responsibility.

Finally, a strong foundation for patient financial management will give providers a leg up on any compliance concerns regarding the relationship with their customers. Widespread patient brokering practices in the industry persuaded Congress in 2018 to include the Eliminating Kickbacks in Recovery Act (EKRA) in federal SUPPORT legislation. Under the law, individuals may not accept or pay any financial reward for a patient referral. When providers do not engage in these practices and are completely transparent with their patients about financial matters, patients know they are operating with their best interests in mind.

A data-driven patient financial management strategy also will meet requirements set out by the Consumer Financial Protection Bureau (CFPB), which ensures consumer access to financial services that are fair and transparent.

Attention to each of these areas — admissions enablement, census growth, clinical adherence, collection of net patient revenue and regulatory compliance — will set providers and their patients on the best possible path for patients' recovery journey. We will explore each of these themes in greater detail in upcoming articles.

At a time when addiction and mental health treatment needs are soaring and with no end in sight, comprehensive care must not be reserved only for the wealthy. Providers can close the gap by engaging their patients in the financial conversation early, equipping them with the tools they need to make the best decisions about their healthcare.

If you would like to learn more about FinPay, click the button below.